In ClimateTech Update articles, I pass along the latest news about companies and topics I have featured in previous columns.

In addition to the normal Updates, I thought I would have an exciting personal update for you today, but a lawyer on the other side of the world still has some t’s to cross and some i’s to dot, so I will hold off for now.

What I can say is that my announcement has to do with applying cutting edge AI technology to the effort to create deeper, more liquid carbon credit markets. Is your interest piqued? Good!

This month, we have so many stories, I’m splitting my updates between two of my focus areas (Post-Carbon Industry and Grid Modernization & Efficiency) and two Big Picture stories:

Post-Carbon Industry

- Heliogen

- Xpansiv

- Storegga

- BlueSource

Grid Modernization and Efficiency

- Wärtsilä

- sonnen

- Swell Energy

- OhmConnect

Big Picture

- Idealab

- Flora Fauna Funga

Post-Carbon Industry

Heliogen

I wrote about Heliogen – a start-up that hails from Bill Gross’s venerable Pasadena, California studio, Idealab – over a year ago in an article entitled Idealab Founder Bill Gross’ Plan To Solve The Mother Of All Quandaries. Heliogen is such an important company because it has developed a method for generating industrial heat using concentrated solar power (CSP).

In late March, Heliogen announced it had sealed a memorandum of understanding with international mining giant, Rio Tinto, to deploy Heliogen’s AI-powered CSP system at the Rio Tinto mine in Boron, California. The two firms have begun the planning phase with the aim of kicking off operations in from 2022.

Heliogen’s system will be implemented to provide supplemental “process heat” to the Boron mine which presently uses natural gas for this purpose. Rio Tinto estimates that the Heliogen installation will allow the California mine to reduce carbon emissions by around 7 per cent – equivalent to taking more than 5,000 cars off the road.

This is such an exciting development for both Heliogen and for our civilization. Bill Gates points out that greenhouse gas (GHG) emissions from industrial sources make up more than one-fifth of total, even before electricity generated for industrial production are factored in. As a civilization we simply must solve the problem of how to create glass, steel, concrete, plastics, and other chemicals without emitting GHGs.

Heliogen’s announcement represents one giant leap forward toward that goal. Bravo, Heliogen!

Heliogen’s CSP test facility in Lancaster, California.

HELIOGEN.COM

Xpansiv

Xpansiv is working hard to create a transparent accounting of the carbon footprint of various industrial and agricultural procedures and also to establish mechanisms and products for trading ESG assets. You can read more about the wonderful work Xpansiv CEO, Joe Madden, and his team across the world are doing from my article Using Big Data And The Power Of Markets To Solve Climate Change.

The news flow out of Xpansiv is indicative of the momentum building behind the company’s vision.

OTX Acquisition

In late March, Xpansiv announced that it had expanded into Europe through the acquisition of Project OTX Limited (OTX) – an ESG product market maker and electronic trading platform with operations in London and Milan which serves more than 200 institutional customers in 27 countries.

With this acquisition, Xpansiv has gained a significant foothold in Europe — arguably, the most forward-thinking region in the world for climate change mitigation efforts and policy support.

Quarterly Volume Record on CBL Exchange

Here’s a tip from an old equity analyst. If you see quarter-over-quarter growth of 68% and year-over-year growth of 98%, something good is happening.

These astonishing growth rates were those recorded for Xpansiv’s CBL exchanges globally in 1Q21 and were led by carbon transactions, US Renewable Energy Certificates (RECs), and over 64 billion liters of water traded on H2OX, CBL’s water market in Australia.

International carbon volumes were boosted by brisk trading in Xpanasiv’s new Global Emissions Offset (GEO) contract. This is a standardized, benchmark spot contract for the global voluntary carbon market that I wrote about in the fall of 2020. GEO volumes were 281% quarter-over-quarter from Q4 2020, when it was first listed.

In addition to the GEO spot contract, on March 1, Chicago’s own CME Group launched the CBL GEO futures contract. CBL also announced plans to trade a new Nature-based GEO (N-GEO) product, a standardized benchmark contract covering the agriculture, forestry, and other land use (AFOLU) sector.

Digital Asset / Xpansiv Partnership

This last announcement is a bit wonky, but exciting to me. Xpansiv announced that it is building out a new platform for developing and managing ESG commodities using Digital Asset’s Daml modeling language. Digital Asset specializes in enterprise blockchain systems and when I read through this announcement, my heart quickened a bit. Essentially, it looks as though Xpansiv is setting up the mechanism to be able to create, track, and trade the Digital Feedstock I wrote about here.

You can’t manage what you can’t measure. The products and markets that Xpansiv is pioneering gives civilization the tools and economic incentive to measure our carbon output precisely and let free markets decide what cleaner products are worth. Bravo, Team Xpansiv!

Using Xpansiv’s technology, commodity tanks of gasoline turn into multi-dimensional “Digital … [+]

XPANSIV.COM

Storegga

Storegga is the British company I first mentioned in my article Carbon Engineering’s Licenses To Print Money and which I will be writing more about in my upcoming series on carbon sequestration.

The big news for Storegga over the past month is that it has received £30m of UK Government funding for the build-out of its Acorn carbon capture and storage (CCS) project in the north-eastern corner of Scotland.

The government funding was routed through the Scotland Net Zero Infrastructure (SNZI) program, an industry match-funded initiative that serves as a catalyst to move the UK toward a national system of low-carbon infrastructure.

Funds will go to a lengthy list of important projects, including paying for engineering work related to Acorn CCS, developing a new CCS-equipped power station at the nearby town of Peterhead and doing engineering design to add carbon capture capabilities to a natural gas-powered plant near Edinburgh, conducting feasibility studies for CO2 transport and storage, and designing a new class of ship to transport captured CO2.

Storegga CEO, Nick Cooper, believes that the funding will put the company on track to become operational within a few years and sees “…the potential to store 20Mt/yr of CO2 emissions from Scotland, the UK and Europe by the mid-2030s.”

In addition to the new influx of funding, Storegga announced that it had become equal partners in the Acorn Project with Royal Dutch Shell and Harbour Energy, the largest UK-listed independent oil and gas company with large holdings in the North Sea.

Many green purists are concerned that oil and gas companies are trying to “greenwash” their reputations by participating in climate restoration initiatives like the Acorn Project.

This criticism represents a topic big enough to warrant its own article, but suffice it to say that considering the monetary and engineering resources these firms can bring to bear on the present climate emergency, this observer at least believes that any movement in the right direction, carbon footprint-wise, is movement in the right direction!

BlueSource

I was excited to see that carbon credit developer, BlueSource – a company mentioned extensively in my coverage of carbon credit markets – announced that it is marketing credits for an urban forestry project in Elizabeth Township, Pennsylvania.

Usually, carbon credits for forestry projects involve thousands of acres of timberland in remote areas. The Elizabeth Township project sells carbon credits against a relatively tiny 150 acres of woodland that might otherwise be turned into strip malls and parking lots.

Another BlueSource-related development I’m watching is that it has recently joined the steering committee for an initiative launched by financial market infrastructure company, IHS Markit, to create a “meta-registry” for global carbon credits. It looks like this initiative is designed to increase liquidity and transparency in carbon credit markets, and any move in that direction is also a good one, in my opinion.

Grid Modernization and Efficiency

Wärtsilä

Wärtsilä, the Finnish company pioneering the development of hybrid power systems about which I wrote in my recent Transitioning to a Smarter Grid article announced that it signed a contract to help my old state of Texas with energy storage.

The green shoots of spring might make it hard to remember that not too long ago, I was writing about the fatal lack of resiliency to climate change-related weather emergencies in the Lone Star state’s independent grid system, ERCOT.

The lack of resiliency was not lost on ERCOT, apparently. In February, Wärtsilä signed an agreement to provide two interconnected stand-alone systems in southern Texas with a combined rated capacity of 200 megawatts (MW) and to underwrite 10 years’ worth of asset performance agreements for these installations.

The Madero and Ignacio energy storage plants are showcases of Wärtsilä’s next-generation, fully integrated GridSolv Quantum energy storage solution as well as the GEMS smart energy management platform I mentioned in the context of an island grid system in my recent article.

The mark of a wise person is that they learn from someone else’s mistakes. Let’s hope that other states will learn from Texas’s painful February lesson and take concrete steps to improve the efficiency and reliability of their own grids.

A grid-scale battery array built for Duke Energy

WARTSILA ES&O

sonnen

I first wrote about virtual power plant (VPP) trailblazer, sonnen, in my article entitled Here Is How To Create A Clean, Resilient Electrical Grid.

sonnen had two notable updates over the last month. First, it announced that it had sealed a partnership agreement with residential solar array firm, Spruce Power Partners, to market sonnen’s battery solutions to Spruce’s existing 50,000 residential solar customers. sonnen and Spruce then aim to create a VPP from that pool of new battery customers.

sonnen also announced that it was embarking on a retrofit project called the Bassett Avocado Heights Advanced Energy Community (BAAEC). This community-scale energy project in Los Angeles County, California aims at decarbonizing an economically disadvantaged community and is backed by a $9 million grant from the California Energy Commission (CEC).

I’m excited to see the BAAEC project, in particular, because it serves both to decarbonize and democratize the electrical grid.

The interior of a unit at the Soleil Lofts in Harriman, Utah, equipped with a sonnen battery pack … [+]

SONNEN.COM

Swell Energy

Swell is another VPP firm I wrote about in Here Is How To Create A Clean, Resilient Electrical Grid.

In the middle of March, Swell announced it was partnering with New York City’s utility, Con Edison, to subsidize battery purchases for 300 customers in the borough of Queens. The customers’ solar arrays, paired with Swell’s battery systems will form a new VPP that will help to reduce stress and increase the resiliency of Con Edison’s grid.

Swell says that the Queens VPP is expected to “…provide 500 kW of clean energy to Con Edison customers during peak periods, lightening the load on the energy grid on summer’s hottest days.”

OhmConnect

OhmConnect has an interesting take on how to implement a VPP based on Benjamin Franklin’s principle of a penny saved is a penny earned. You can learn more about what the company is doing by watching my video feature about VPPs.

OhmConnect has partnered with smart home equipment maker Google / Nest for some time and the tie-up proved to be a big boon for California last August during its terrible heatwave.

Thanks to OhmConnect’s AI-powered VPP, California homeowners reduced their energy usage by 1 Gigawatts, which in turn helped to prevent six more days of blackouts during the crisis.

These strategically-timed demand reductions benefited customers as well – earning families in the OhmConnect network $1.3 million in bonuses in addition to reducing their electricity bills.

This week, OhmConnect and Google announced they are launching a new partnership to supply heavily discounted or free Nest thermostats to all California residents who connect their PG&E, SCE or SDG&E utility accounts to OhmConnect’s platform.

OhmConnect and Google both hope that the increased proliferation of smart home devices networked into a VPP will allow for even greater energy savings and even more relief to the overworked California grid this summer.

Equipped with Nest thermostats, OhmConnect’s growing community of energy savers will be a critical … [+]

OHMCONNECT

Big Picture

Idealab

For those interested in the venture and entrepreneurship space, you’ll be interested in reading my interview with Idealab founder Bill Gross, published last year as a follow up to an article I did about his start-up, Heliogen.

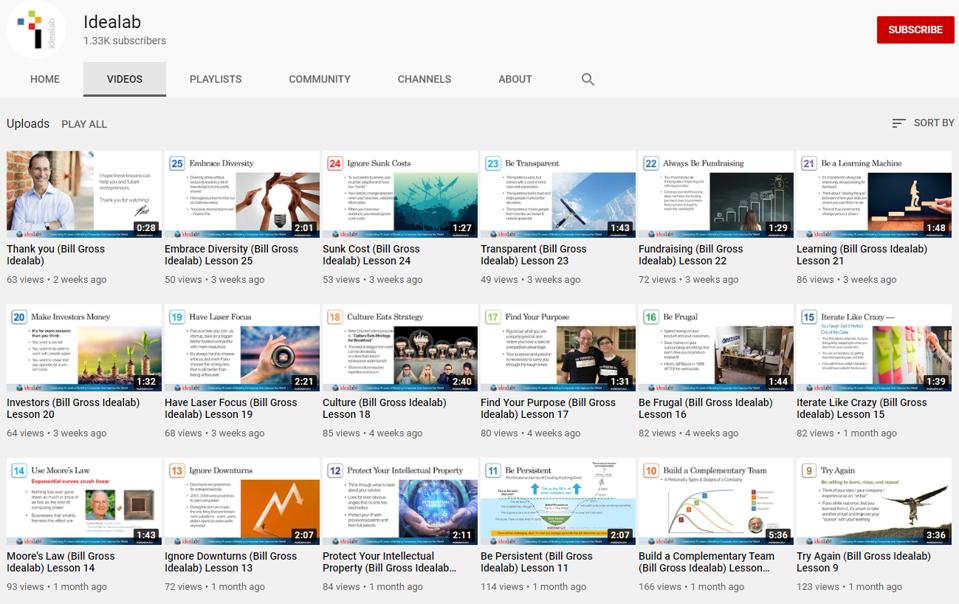

You’ll be even more interested in watching Bill’s video series 25 Lessons in 25 Years, which you can find on Idealab’s site and on its YouTube channel.

Gross founded Idealab on Pi Day, 1996 (3.14.1996), so Pi Day this year marked Idealab’s 25th birthday. In celebration, Gross posted videos containing the 25 most salient lessons from his (even longer) career in entrepreneurship and incubating start-ups.

The videos are wonderful! They include lessons like Be Frugal, Try Again, Be Success Sensitive (Not Dilution Sensitive), Be Persistent and many, many more. Take some time to watch these videos – class is in session and there is plenty of inspiration, as well as sound advice, to be found here.

Idealab’s YouTube channel

YOUTUBE.COM

Fauna Flora Funga

Recently, I have been afforded a wonderful opportunity to speak with several global experts in the field of mycology.

My discussions with these experts have been so interesting that I have decided to write in more depth about the terrific scientific work being done to understand how fungi help protect and preserve the balance of life on this planet.

One of the experts at the University of Oregon wrote me about a campaign known as Fauna Flora Funga, which seeks to increase focus on fungi in global discussions of biodiversity and ecosystem preservation.

Fungi exist as a separate kingdom – they are neither plants nor animals – but the kingdom is, by and large, ignored in conservation programs.

Considering that the largest living organism on the face of the earth is a fungus, ignoring this kingdom really means ignoring the elephant in the room.

A group of scientists have come together to create an organization to ensure that global conservation efforts include consideration for this largely invisible but hugely important kingdom of life forms. Reading through the Fauna Flora Funga site is fascinating and contains some truly surprising facts about how helpful fungi are to human health and to life on earth. I encourage everyone to take a look at the site and to stay tuned for a more in-depth article from me later this year.

Fungi are critical to human, ecosystem, and planetary well-being.

FAUNAFLORAFUNGA.ORG

Our civilization faces some daunting challenges, but also some wonderful opportunities to rethink and restructure our society to work in concert with our environment.

It is time for all of us to redirect our own personal, intellectual, and monetary capital to support this transformational work — the potential returns are huge, as are the risks if we fail to act.